(Bloomberg) — Traders on Wall Street cheered Wednesday when Federal Reserve Chairman Jerome Powell signaled that he doesn't see an imminent interest rate hike despite inflationary pressures. The celebration did not last long.

Most Read from Bloomberg

For a brief period, US stocks unleashed their biggest post-policy meeting rally since December, while Treasury yields fell more than 10 basis points in maturities. Relief trading began when Powell told reporters that “the next rate hike is unlikely.”

The problem is that Powell hasn't explicitly signaled a rate cut is coming this year either, and has said it will take a long time for central bankers to gain enough confidence in inflation's downward path. That reality check sparked a sudden reversal in equities, which ended the day lower. Treasury yields pared some of their decline, with the policy-sensitive two-year yield below the 5% range — but not much higher.

“Powell made it clear that the hurdle for hikes is incredibly high,” said Michael de Bass, global head of rates trading at Citadel Securities. “They're looking at eventually capping rates, that's undeniable. The questions now are whether they're capping enough and how long it will take to drain the economy.

The market's reaction to the idea that rate hikes may be off the table shows how much sentiment has changed since the start of the year, when the consensus called for more rate cuts and an expected steady decline in inflation. Forecasts for higher interest rates were lower.

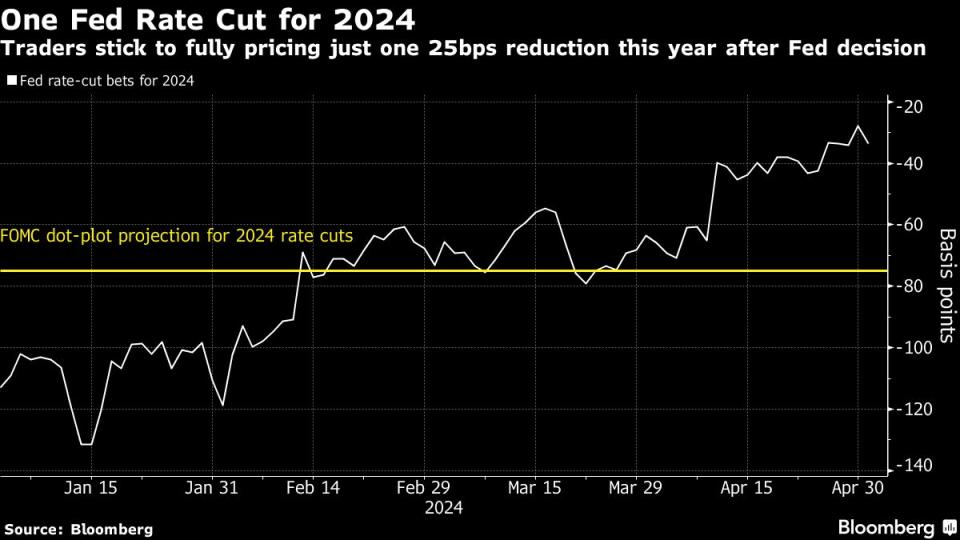

Lately, however, investors — especially in the world of Treasuries — have had to worry about a potential hike from the Fed as the U.S. economy remains resilient, job creation runs strong and inflation remains difficult to control. Bond traders have cut their outlook for a rate cut to just over one from six quarter points in early January.

A sell-off in equities and bonds in April pushed back two-year Treasury yields by more than 5% and sent the S&P 500 index to its worst monthly loss since October, underscoring tensions building ahead of this week's Federal Open Market Committee meeting. More key data is still on deck: Friday's April jobs report is expected to show strong jobs growth, while more inflation reports are due in the coming weeks. Central bankers must weigh everything.

“The FOMC appeared to want to keep the market from running away from its fundamentals of solid growth, sticky inflation and its intention to taper later this year,” said Citigroup Inc.'s Stuart Kaiser. strategists wrote in a note. Creation of a Federal Open Market Committee. “The result was a big round-trip trading day.”

Stocks for investors were highlighted when Powell said that while he believes current rate policy is “restrictive, and over time, it will be sufficiently restrictive,” “that's going to be a question that the data will have to answer.” “

Even as Powell acknowledged the recent lack of progress toward the Fed's 2% inflation target this year, his signal that cuts would outweigh hikes was enough to calm the market, at least initially. Whether it guarantees a steady stock boom is another matter.

Here's what Bloomberg strategists say…

“Powell: Rate cuts still on the table before year-end. Takeaway: Rates are capped, but Fed will ease if unemployment rate rises further from here. Fed has an easing bias.”

– Edward Harrison, Markets Live blog contributor

“I'm very confused trying to figure out what Powell said to cause stocks to rise so sharply,” said Steve Sosnick, chief strategist at Interactive Brokers. “Sure, he said hikes weren't needed and downplayed fears of stagnation, but that's not worth a huge speculative rally.”

As for the longevity of the recent bond relief rally, Citadel's de Bass warned that while the bounce is “meaningful,” the market is approaching its limits.

“It's already running out of steam in the market because yields are down,” he said. “The market is struggling to operate even more because we're in a data-dependent space.”

Most read from Bloomberg Businessweek

©2024 Bloomberg LP